INSIDE

Capacity Movements

What we are seeing across the country in equipment capacities.

Rate Trends

Tracking market shifts

Forecast

What we see on the horizon for the month ahead

STI Global, Inc

Market Trends Newsletter

Latest market insights

Fuel Prices Back on the Rise

Fuel prices are one of the strongest impactors of carrier financial strain and when coupled with other data are a good indicator on where capacity may be heading.

The national average of diesel has risen by $0.23 per gallon since the beginning of January. Carriers have been particularly feeling the pain in the Midwest where costs have risen more than $0.30 per gallon in this same time frame.

Rising fuel costs are a key driver in freight rate increases and as you will see in our Rate Trends, this is being reflected in markets where cost spikes have been less gradual. With OPEC reporting expected demand increases and downgrading their expected supply increases, this indicates a continued rise in future costs.

Capacity Movements

STI tracks capacity movements nationwide as part of our forecasting data to help our partners prepare for the month ahead.

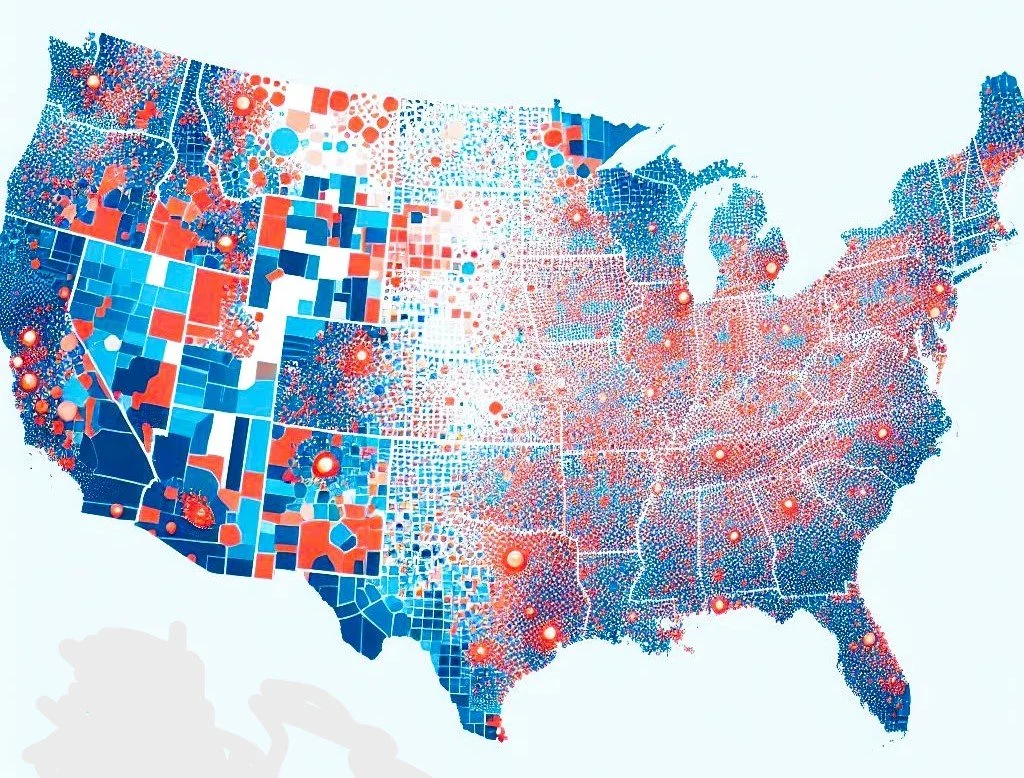

National capacity remains fairly loose helping to keep rates relatively stable. However, overall capacity is shrinking. The national carrier pool shrank by more than 4500 providers since Jan 1.

We have seen some tightening in the Southeast and Mid-Atlantic regions. Particularly Southeast TX, GA, and AL. We have also seen some constricting capacity in the great Memphis area, OH and IN. These capacity strains are definitely affecting pricing in those regions.

We have also seen some loosening in other regions of course. North TX, CO the Northeast and the West regions have all seen significant capacity increases leading to softer rates.

Forecast

What the data is telling us to expect.

The coming produce season could provide a rate shakeup as those increasing demands pull capacity from other areas though we expect it not to be too impactful. The overall market continues to be relatively depressed, and capacity overall is abundant even as the industry continues to lose providers gained during the pandemic. Load volumes remain low across most of the country. However, the data is showing us that regional load volume spikes will create capacity crunches as trucks flow to those regions. Patient shippers that have the flexibility to hold their freight through a day or two of spikes will be rewarded with cost savings. Overall low volumes will continue to depress the market so rate spikes will be short lived.

February 2024

Issue #1

Rate Trends

STI examines rate trends over the previous month to provide our partners with regional data to help them understand what may affect their own costs.

National Rate Trends (Traditional):

Van: Decreased slightly by 1.5%

Reefer: Decreased slightly by 3.5%

Flatbed: Increased slightly by 1.2%

National Rate Trends (Specialized):

Box Truck: Decreased significantly by 12%

Sprinter: Decreased by 8.2%

Highlights:

Rising rates in Southeast TX and throughout the Southeast from west TN to west Carolina. Also, we are seeing rising rates in the Mid-Atlantic region, specifically Ohio and Indiana.

Rates are cooling in North TX, the Midwest and the Northeast and even further cooling on the West Coast.